Since the launch of Chatgpt at the end of 2022 and the rise of generative artificial intelligence (IA), the name of Nvidia has been on all mouths in the industry. The flea manufacturer undoubtedly stands out as the big winner of recent years thanks to a technology that surpasses all the others. A feat, while the company was above all a key player in video games.

The number 1 of 3D graphics

The figures speak for themselves. According to market research firm IDC, NVIDIA today controls around 90 % of the GPU market (graphic processors) for data centers, that is to say the chips used to cause and run artificial intelligence (AI). Its market capitalization has literally exploded since the beginning of 2023, by making one of the most valued companies in the world alongside mastodons like Apple, Google or Microsoft.

Founded in 1993 by Jensen Huang, Chris Malachowsky and Curtis Priem, Nvidia had the ambition to revolutionize the video game thanks to her chips. And its beginnings were difficult, with the development of two models which encountered a bitter failure. It was their third attempt, the Riva 128, which was successful in 1997 by flowing to 1 million units in just four months.

Once on the right tracks, The company has chained the development of new products acclaimed by industry, hoisting it to the rank of undisputed leader in 3D graphics. In the 2000s, its technology passed video games in a whole new dimension, but the company must also face increased competition. In parallel, its engineers realize that its graphic accelerators can be used in other applications. A boon for researchers in artificial intelligence, who realize that their theoretical work can materialize using NVIDIA technology.

Tilting to AI: a paid choice

Over the years, there are always more many of them turning to the GPUs of the company. Aware of the issue, CEO Jensen Huang chooses to go concretely in AI. It is a historic turning point for Nvidia: we are in the early 2010s. For almost ten years, the firm improved its accelerators, and never breaks dialogue with researchers in order to best optimize their performance.

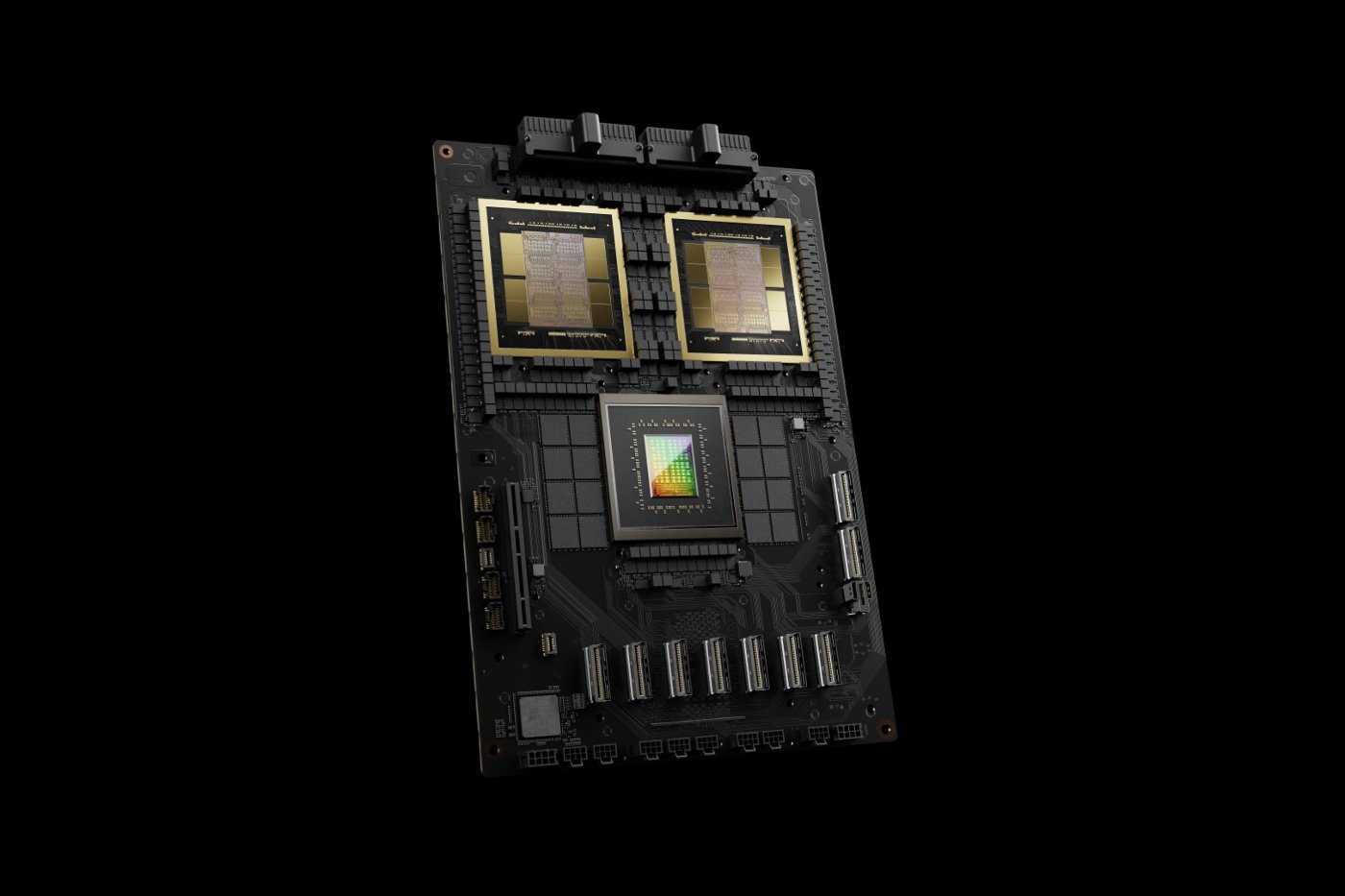

When generative AI officially becomes a trend, society is already on the war foot, and no one arrives at the ankle. His H100 chip, inspired by his units dedicated to gaming, sells like bun. His even more powerful Blackwell successor also attracts all lusts.

Because Nvidia processors allow several computers to work together as if they were only onehelping them to process a huge amount of data very quickly. And precisely, the calculation power required to train and operate the models is astronomical.

But beyond the material power, Nvidia has another major asset: Cudaa language specific to its chips which facilitates their programming for AI. Its massive adoption locks the ecosystem, making any transition to a more complex alternative for businesses.

Competition does not make the weight

The request is such that the company is regularly out of stock. These shortages lead to a significant increase in their price, because it sells more chips than it can produce, even for its old models.

It is therefore without surprise that the cloud giants like Amazon, Google and Microsoft are trying to develop their own chips to reduce their dependence in Nvidia, but without real impact for the moment given the scale at which the company operates. Its rivals in the flea sector also enter dance. AMD, for example, is focusing on its instinct MI350 range, expected in mid-2025, to gain ground. But despite $ 5 billion in annual income in this sector, the company remains far behind the Jensen Huang firm, which exceeds $ 100 billion.

Intel, for its part, is even more in difficulty: after the failure of its Falcon Shores project, the company has given up entering the IA flea market seriously for the cloud. And even if accelerators came to display performances similar to those of Nvidia, the transition would be tedious for its customers as Cuda architecture is anchored in their systems.

For how long?

The manufacturer’s monopoly seems very hard to come and tickle. Especially since he is able to quickly update his offers at a rate that no other company has yet been able to match. Its system also allows its customers to buy H100 roughly and deploy them quickly.

However, some signs indicate that the explosion of data centers could calm down. And the arrival of Deepseek in the AI landscape could even change the situation. The Chinese startup has indeed managed to develop a model capable of reasoning by exploiting much less powerful Nvidia chips, at lower costs than its American competitors.

Its impact on the chip giant could be important, as evidenced by the tumble of the course of its action in the aftermath of the presentation of the Deepseek AI. Jensen Huang, he minimizes the progress of the young shoot, while the sales of his firm continue to soar.

Despite everything, Nvidia was able to build an empire almost unshakable in the field of AI. But if the American giant seems firmly installed on its throne, the history of technologies has proven us many times that no hegemony is eternal. Nvidia will have to remain vigilant in the face of approaches that could gradually erode her supremacy.