You may have an emergency or run into trouble just before you get paid. Cash advance apps help you to borrow money from your upcoming paycheck. Short-term options can be paid in advance with upcoming direct deposits. But they might be expensive.

We examined some of the best cash advance apps to help you decide whether this type of short-term loan is right for you and which is the best cash advance app among all.

What are cash advance apps?

Cash advance apps are used to bridge the financial gap between paychecks. You can connect your bank account by entering your job and income information. Then, you can transfer a portion of your upcoming income directly to your bank account or specified debit card.

Cash advance apps can be useful for people who are dealing with unexpected expenses (like car repairs) or need money quickly.

They may also benefit consumers facing penalties for having too little money in their checking account.

Top 10 Best Cash Advance Apps in 2025

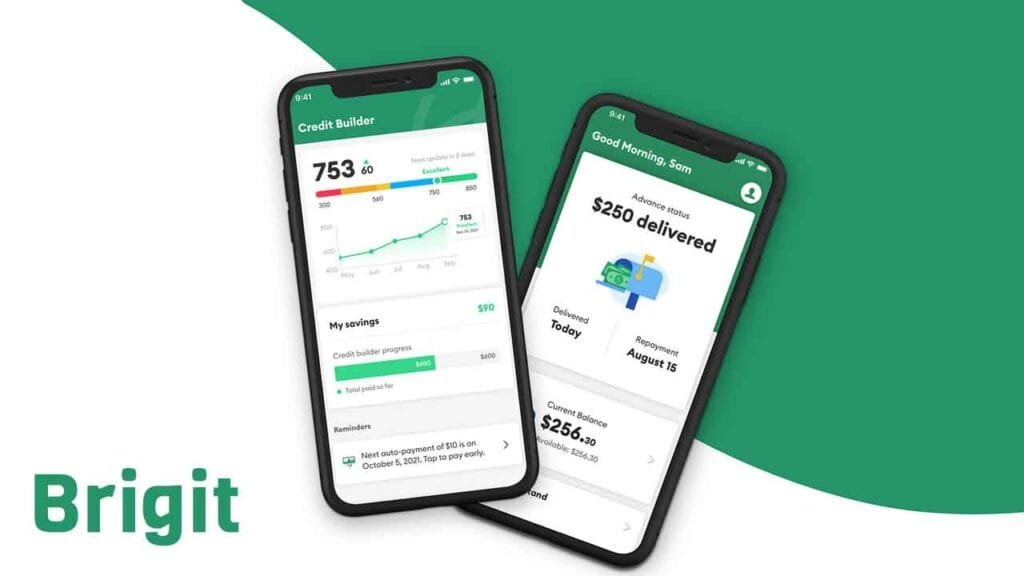

1. Brigit

Brigit, a savings app, also has the option for you to get a cash advance. The app offers both a free plan and a subscription service, but in the subscription plan, you can only make cash advances. Brigit’s membership plan gets you credit tools, ID theft insurance, and overdraft coverage, as well as cash advances and free plans.

Once you upgrade to Brigit’s payment plan, you can borrow up to $250 for each cash advance. If you request early in the morning, you can get the money the same day as the advance turnaround is quite fast. If you request an advance after 10 am EST, you can expect to receive the advance the next day. Although you can request an extension, you will make your advance payment after you receive your next paycheck. These extensions are limited to one every two times you make the advance payment at the scheduled time.

2. EarnIn

EarnIn, a paycheck technology app, allows you to borrow money you earn by tracking your work hours or location. The app also has a feature that tells you when your bank account is low and automatically tops up your balance.

EarnIn has the highest amount of advances on our list for a long time, letting users withdraw $100 per business day (maximum $750 per pay period). What we also like—EarnIn relies on an optional and refundable tipping mechanism to earn money on its cash advance products, rather than charging a monthly fee or automatically enrolling you in a money management app. Don’t let the increasing convenience in our economy with tipping keep you from paying too much for your loans, especially small loans.

3. Empower

Empower is a cash advance app that focuses on building your credit. It also offers savings, bank accounts, and other financial instruments. Empower app lends to you for cash advances up to $250 and has a one-day turnaround to receive your advance. If you want to pay the express fee, you can get the cash advance within an hour.

To use Empower you will have to pay a monthly subscription fee. If you want Express Cash you will have to pay the instant delivery fee and the option to tip. You can ask them to change your repayment date if you prefer, but Empower will ask you to repay your advance on payday.

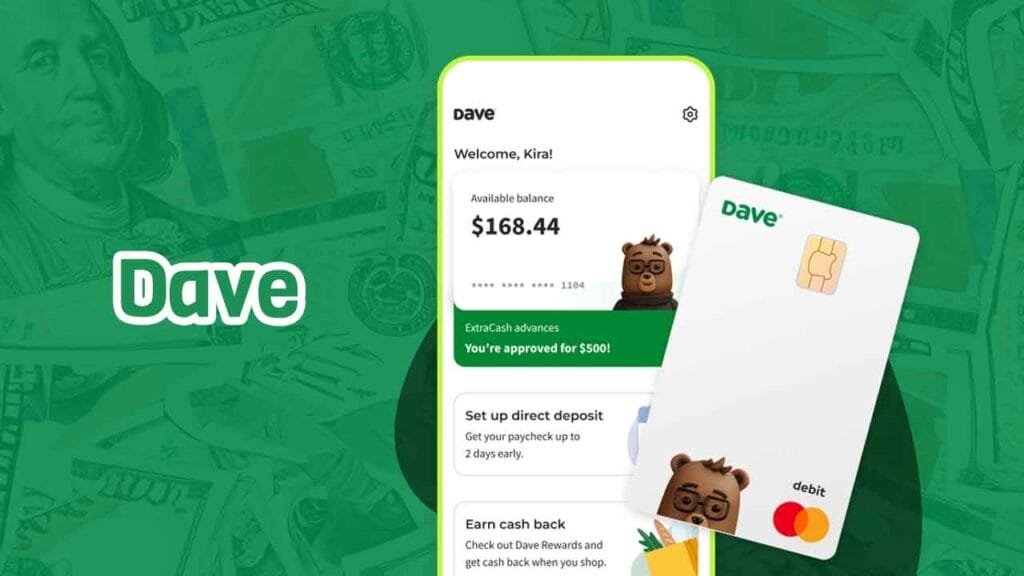

4. Dave

Dave, a cash advance app, allows you to borrow extra cash after opening an account. These small loans can be used to make sure you have enough money to pay your bills or for any other reason you may need the money.

You have to pay a fee to open an additional cash account with Dave. If you need to get money quickly, Dave also has a monthly subscription fee and an express fee. Express fee will be more expensive if you are making the transfer to Dave Bank account. Funds will usually be sent within one to three days without express fees.

If you have a question How much can you borrow? For this Dave allows you to make an advance payment of up to $500. Although extensions are available, this amount must be paid on the next payday.

5. Varo

Varo offers banking customers a cash advance of up to $500 with instant funding. Although the company claims “0% APR” cash advances, there is a required and hefty fee with each advance. Users can pay up to $40 to borrow $500.

Cash advance competitors often ask for an optional fast funding fee of a few dollars and at most an optional tip. Varos funds cash advances instantly, with no tips.

6. SoLo Funds

SoLo Funds offers peer-to-peer cash advances. Users send loan requests to the app’s marketplace, which lenders (other consumers) select. The app has lower fees, is more optional, and lets users choose their repayment dates.

However, it may take up to three days to know whether your requested loan will be funded; This is longer than other apps take to approve and send advances.

7. MoneyLion

The MoneyLion app offers cash advances up to $500, financial tracking, credit-builder loans, and mobile bank and investment accounts. Anyone with an InstaCash Advance qualifying checking account is eligible to use it. MoneyLion members have access to the fastest funding times and larger advances.

MoneyLion is an all-in-one money management platform with products ranging from wealth management tools to credit builder accounts and, of course, cash advances, with no monthly fees. However, a quick transfer fee (also called a turbo delivery fee) applies, which is slightly higher for those transferring to an external account (instead of a RoarMoney account).

8. Klover

Klover offers a $100 advance based on bank account eligibility and another hundred dollar advance based on program participation. To participate in the points program, users are required to upload receipts, take quizzes, and watch videos, which are converted into dollars, which can be received as advances or fees.

Klover makes money by collecting aggregate user data and sharing ideas with its partners, so if you have data privacy concerns, Klover is not for you.

Klover is a cash advance app that offers multiple financial instruments and services. Although you can get points to increase the amount you can borrow by using Klover’s service, they typically have a $100 advance. Clover also offers same-day advance payment for express fees. You have the option to subscribe to Klover+, which gives you even more financial tools and services than their basic offerings.

Although Klover does not charge membership fees for advance offers, you have very little money left before you can receive points from their points program.

9. Current

Current will offer you fee-free overdraft protection if you sign up for its checking account and debit card. Coverage with OverdriveTM can range from $25 to $200. You’ll need $500 or more in monthly salary or government direct deposit, more than competitors.

The app sends a notification that you’re eligible to enable Overdrive. Current sets its overdraft limit, which can change depending on various factors such as what happens to the account.

The overdraft will only cover purchases made with your current debit card. Coverage will automatically apply when you select it, and the app will let you know when that happens. To repay the overdraft, Current will pay from your next deposit without any fees.

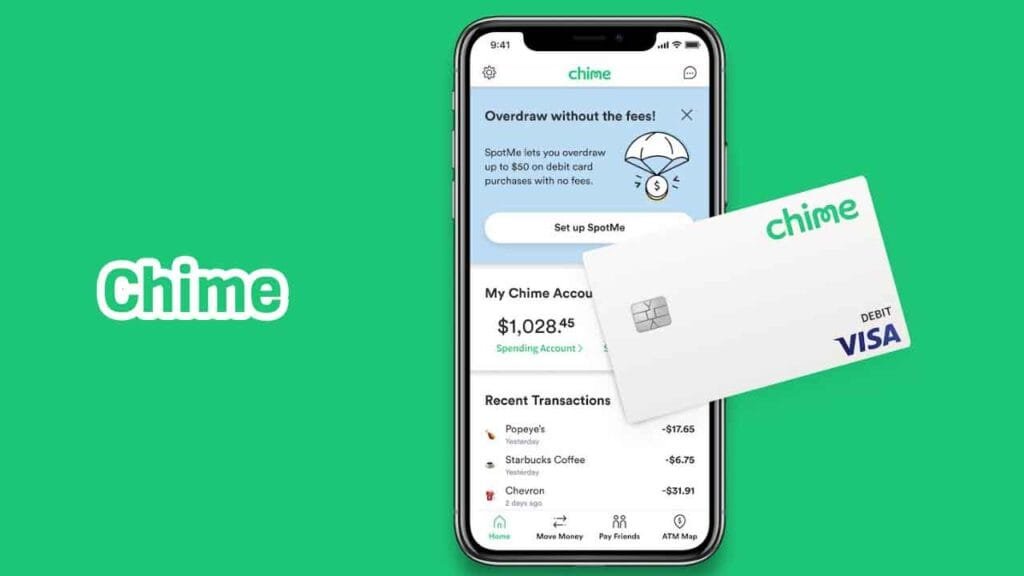

10. Chime

The Chime app doesn’t typically offer cash advances, but it can give you $200 in overdraft coverage with the free optional SpotMe service. To be eligible you must have a Chime debit card and checking account, as well as at least $200 in monthly direct deposits from an employer or another payroll source.

To set the SpotMe limit, the Chime app reviews the account and spending. This means that your limits may change at any time. SpotMe coverage applies automatically when enabled and only applies to Chime debit card purchases and ATM withdrawals. Chime collects the money when the next deposit comes to your account. You may choose to tip, but there is no charge.

How To Choose The Best Cash Advance App

Cash advance apps are the perfect solution when someone wants a little stretch of cash. These apps allow you to borrow money, which you can use to buy groceries, pay bills, or anything else you need.

Payday loans would be an easy comparison, although apps are often much more affordable and convenient than working with a payday loan company. Apps usually let you borrow very small amounts and not pay exorbitant interest rates.

Of course, there are plenty of cash advance apps available today. It can be hard to decide which is best with so many options. Luckily for us, the best of the best are available, so we’ve picked out a few of these so you can spend more time researching and getting the money you need.

Conclusion

Cash advance apps can give you temporary money until you get a paycheck as long as you use them responsibly. Because it has no required fees and the highest advance limit, we recommend EarnIn as a top app. Dave and Brigitte are great for flexibility and small progress. If you are okay with just overdraft protection then it is worth considering Chime and Current.